Employee health insurance is a benefit that companies give. It’s important because it helps people get the care they need when they are sick. However, lots of companies have to limit what they offer for health insurance. They can’t provide medical coverage because it’s expensive. This blog post will help you understand the choices that you have about your business’s coverage options.

Contents

- 1 What is Employee Health Insurance?

- 1.1 Benefits of Employee Health Insurance

- 1.2 How to Raise a Claim?

- 1.3 Is Employee Health Insurance Compulsory in India?

- 1.4 Understanding the Basic Coverage

- 1.5 Inclusions in Employee Health Insurance

- 1.6 Exclusions in Group Health Insurance

- 1.7 Why Protect your Employee Health Insurance?

- 1.8 A Word From Mantra Care

What is Employee Health Insurance?

Employee health insurance is a type of medical coverage that protects employees. If someone has an illness or injury, you can protect them with this kind of policy. They will be able to work and make money, which makes it good for both them and their employer.

There are a lot of different types and levels of coverage available. Some may provide medical care, while others may focus on your teeth or eyes.

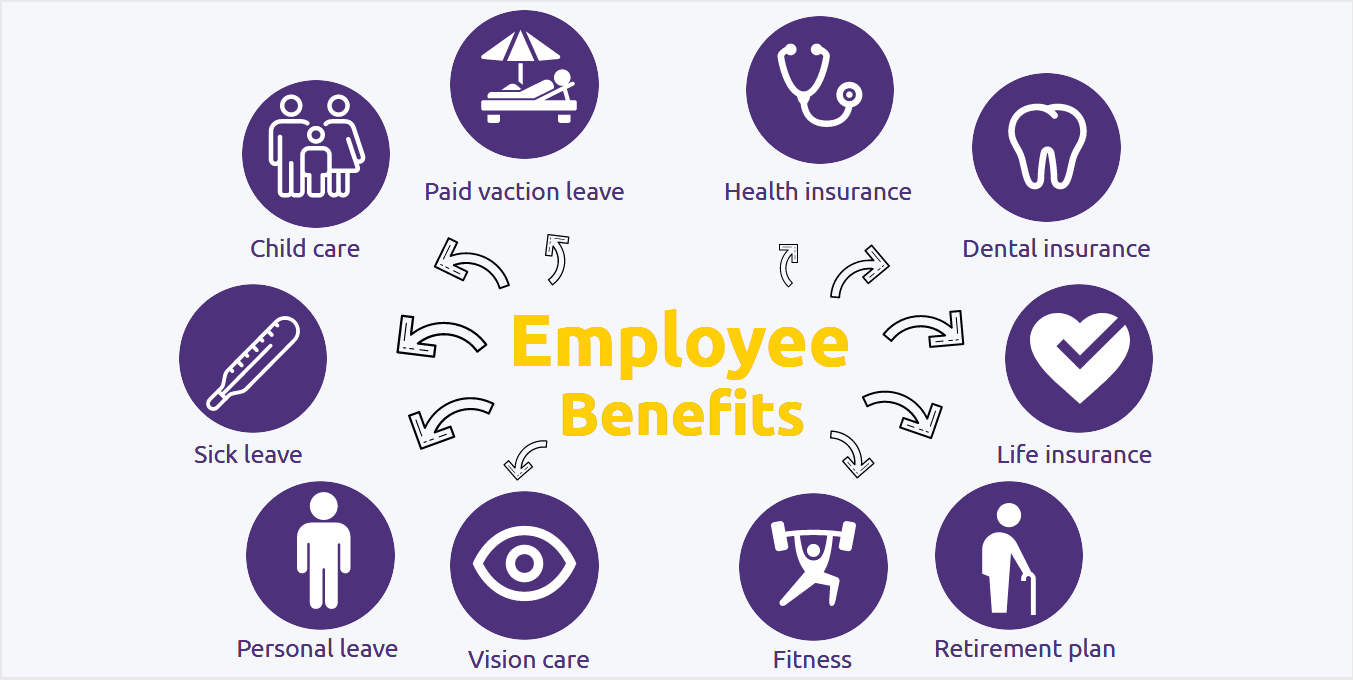

Employee health insurance is usually part of the company’s benefits package for employees. Life insurance, disability income protection, and a retirement savings plan are also often included in this package.

If you have a pre-existing condition and apply for health insurance, it can still cover treatments. This is helpful because you will not be denied coverage and your income won’t change because of the illness.

Companies are looking for ways to cut back on expenses. They do this by reducing the amount they pay for healthcare. One way they do this is by not giving insurance to their workers.

Employers and employees are worried about health insurance. Health coverage has been expensive for a long time. Employers want to cut back on what they offer employees. But that can be bad for workers if something goes wrong. Here is how you can work with your employees to find out what their options are:

Benefits of Employee Health Insurance

Many employers offer some form of healthcare coverage to their workers as one way to retain talent and recruit new hires. But what exactly do they provide, how much does it cost them, and what do employees really get out of it?

Free Health Insurance

Offering your employees free health insurance may seem like an impossible dream, but it’s actually possible if you know how to do it.

Employees do not have to pay an insurance premium in order to obtain the benefits of this plan. The employer pays the premium as a prerequisite/benefit for being a member of the firm. This sort of group coverage includes your family members as well. And to be able on top of rising healthcare expenditures is quite advantageous in itself.

Top-Notch Coverage

Even if a Group Medical Cover for Employees is available free of cost, it can be of high quality. For example, ACKO’s Employee Health Policy comes with the following features:

1) It provides health insurance coverage for children up to age 26.

2) It includes maternity benefits which are absent in some plans.

3) The policy covers hospitalization expenses.

4) There is no waiting period.

5) The COVID-19 cover is a type of insurance that protects you and your family from significant medical expenses.

6) Out-patient Treatment (OPD) cover

7) For a small fee, you may schedule an appointment with a medical professional for a teleconference.

8) Booking lab tests is now easier than ever.

Prevention Healthcare benefits

Prevention is the best cure. In order to maintain a healthy workforce, it is important that employees are provided with preventive healthcare benefits. This helps prevent diseases from spreading and infecting others around them too. Furthermore, this also minimizes health risks of staff members which may otherwise lead to high medical costs in the long run.

How to Raise a Claim?

Employee health insurance can be a great way to help employees save money on their medical bills. Employees do not have to pay anything when they visit the doctor or go in for treatment, but instead have most of it covered by their employer. In return, employers get an affordable and flexible package that helps them provide better benefits to their staff. It is not as complicated as it may sound; with a bit of guidance and support, employees will be able to easily navigate the ins and outs of their insurance coverage.

- The employees have to submit a claim form when they need reimbursement.

- Employees can raise their claims by calling the customer service number or filling up an online claim form which is available on the website of your insurer.

- Employers can choose to pay the insurer directly. They can claim these expenses from their employees.

Is Employee Health Insurance Compulsory in India?

Employee health insurance is not compulsory in India. However, it’s a great way to attract and retain employees at your organization. There are also many benefits of having an employee health Insurance program for both you as the employer and your workforce. These include:

- Health checks: Your employees will be able to access different types of health care services at a low cost. They will receive regular check-ups and tests, which enables them to prevent prevalent diseases early on.

- Reduced absenteeism: When your employees are healthy, they’re more productive and less absent from the workplace. This means that there is no disruption of business processes as well as zero loss of productivity.

- Increased morale: Workers tend to be more motivated and engaged when they know that their company cares for them. This contributes to the overall success of your organization as well as its culture, which is especially important today with Millennials entering the workforce in significant numbers.

- Reduced costs: Employee health insurance helps you reduce the cost of hiring employees. When your company offers this incentive, it attracts more people to join. It also makes existing staff feel like the company values them. This also helps you to retain staff for the long term.

Employee health insurance is a great way to attract and retain employees, reduce absenteeism, improve morale, and more! If you want to provide this benefit for your workforce, contact our experts at Mantra Care today.

Understanding the Basic Coverage

Employees can get insurance for free. The employer pays for it. This insurance covers hospitalization costs, which is when you go to the hospital.

Recent Update:

There was no specific regulation requiring such a cover until 2020. After last year’s epidemic-ridden year, new rules are there to safeguard the public against future pandemics.

- According to an IRDAI circular, medical insurance will be made compulsory on April 1, 2020.

- After the lockdown was lifted, businesses were required to follow a Standard Operating Procedure for resuming operations and offering insurance to employees.

- The IRDAI released this circular to insurance companies in order to comply with government directives.

- The IRDAI advised non-life insurers to create comprehensive, inexpensive, and easy-to-understand insurance documents.

Inclusions in Employee Health Insurance

The following are covered under a group health insurance plan:

1) A group health insurance policy covers a group of persons under the plan.

2) It also covers medical expenses for illness, diseases, and injuries. It also includes pre-and post-hospitalization fees.

3) For an extra cost, you may add a member’s spouse and up to three children, aged between three months and 25 years or other dependents.

4)There are no administrative costs at the hospital, and everything is handled through a single accounting office. By utilizing the policy’s cashless facilities and direct payment of bills with the facility, you’ll save time and money on paperwork.

5) The actual costs of maintaining a house, which are known as “domestic expenditures,” can also be paid through this program. You may even pay for things like gardening and lawn maintenance. This benefit can save you money on your taxes too!

6) The price of employee health insurance or corporate health insurance plans varies from firm to firm, and each company has its own set of employees.

Exclusions in Group Health Insurance

The following are some of the exclusions that may apply to your group health insurance policy:

1) An insurance policy only becomes active when you enroll. But, people with pre-existing conditions are not covered by group health insurance plans.

2)Although these procedures are not specifically mentioned, they must nevertheless be completed or accomplished. These practices do not include any necessary medical treatments or exams.

3)Any employer health insurance or company health insurance plan does not cover memberships in the following categories.

4)This sentence means that if someone dies during a war, the death isn’t counted in the records.

5) You might not need to buy these things. You can get them for free from your health insurance company.

6) Some treatments for your teeth are not covered, like fillings and crowns. And some operations that are needed while you are pregnant will also not be covered.

Why Protect your Employee Health Insurance?

Employee health insurance is a cost-effective way to protect your employees in the event of illness or injury. As well, you can help reduce stress on them and their families when they are thinking about how to pay for medical costs. Research shows that people are more likely to seek care and follow their course of treatment when they have private medical insurance. In addition, some employees will go to work even if they are sick or injured because they don’t want to lose money from being away from the job. A recent study found that those who had health insurance missed on average three fewer days of work each year than those who didn’t have health insurance.

The value of having private medical insurance is not just about the benefits to employees. However, mployers also stand to benefit by offering their employees access to quality and timely care when they need it most: illness or injury. It’s a fact that many people delay seeking treatment until symptoms are severe enough for them to miss work. And that’s not good for the employee or your business. When people are not at work because they are sick, injured, or have to care for a family member who is sick, they lose productivity. Businesses also incur additional expenses in hiring temporary workers while regular staff members are away from their jobs due to illness or injury.

Boost Employee Retention

Jobs that provide a sense of security are more desirable. A group health insurance will not only provide your staff and their families with enough financial stability, but it will also give them a feeling of well-being as their employer truly cares about them.

Financially secure them during the COVID-19 Pandemic. During the epidemic, financial security has grown in importance owing to the recession and pay cuts in numerous sectors. The most important thing you can do to guarantee your workers’ financial and medical well-being is to safeguard them from treatment costs that may result from this virus.

Strengthen Employee Motivation

Happy employees create positive work environments, as do successful businesses! It’s no surprise that happier and more enthusiastic workers are safer and more comfortable.

Make sure you keep them safe from diseases. More than 61% of sickness hospitalizations and deaths in India are from lifestyle-related illnesses. Keep your workers safe from the same, among other things, by detecting them as quickly as possible.

Many people are anxious. Some individuals become agitated when things get difficult. Our health insurance will safeguard their money while also providing mental health treatment.

A Word From Mantra Care

Employee health insurance is when the company takes care of your health. That’s what they do when they give you money and other things like vacation time, sick leave, and bonuses. The company might also offer you a plan where you can buy food. This is a good way to get health care. The group will help you with your body and teeth. You can have a fitness membership, lose weight, or stop smoking. This all costs less if your company pays for it. You can also check our employee health insurance program, Employee health benefits.

Do you want to keep your employees happy, healthy, and productive? Join our employee assistance program and get a healthier workplace.