It is not uncommon for people to neglect their mental health, specifically when they are experiencing financial stress. This can lead to significant problems in the long term and even worsen the existing financial stress. More often than not, the two go hand-in-hand and it’s important for someone who is constantly feeling both financially and mentally stressed to seek help.

Contents

- 1 Financial Stress And Mental Health

- 2 Connection Between Financial Stress and Mental Health

- 3 How Can I Cope With Financial Stress?

- 4 Mental Stress

- 5 Signs of Financial Stress

- 6 Effects Of Financial Stress On Your Mental Health

- 7 Ways to Address These Stress

- 8 Tips for Combating Financial Stress on Your Own

- 9 Conclusion

Financial Stress And Mental Health

Financial stress and mental health are two issues that many people deal with at the same time. It’s important for someone who is constantly feeling both financially and mentally stressed to seek help. If you’re feeling this way, take a look at some tips for combating financial stress on your own, then seek professional help if you need it.

Financial stress is more common than you might think. It’s reported that one in five Americans are experiencing financial stress right now, which means about 20 percent of the population are struggling to make money last throughout the month or making ends meet with debt on a daily basis. This affects people on all economic levels, no matter how much they earn, and it can be particularly difficult for those who are unemployed or working several part-time jobs.

Mental health conditions are also prevalent among Americans today, affecting nearly 20 percent of adults within the population. As with financial stress, mental health issues don’t discriminate based on income level or even profession — these problems affect everyone at some point in their life without regard to sex, age, race, or socioeconomic status.

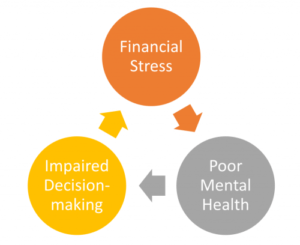

Connection Between Financial Stress and Mental Health

People often neglect their mental health when they are experiencing financial stress for several reasons. First, it might be difficult to find the time or energy to focus on your emotional and psychological well-being when you’re struggling just to get food and shelter. Second, many people believe that they should simply be able to work through these feelings on their own rather than seek professional help. Some even feel ashamed of admitting that their finances have become an issue in their life, especially if it means turning over control of the situation to a therapist.

People often neglect their mental health when they are experiencing financial stress for several reasons. First, it might be difficult to find the time or energy to focus on your emotional and psychological well-being when you’re struggling just to get food and shelter. Second, many people believe that they should simply be able to work through these feelings on their own rather than seek professional help. Some even feel ashamed of admitting that their finances have become an issue in their life, especially if it means turning over control of the situation to a therapist.

Finally, there is some level of guilt attached to both financial problems and mental health issues because it oftentimes results from poor decision-making or lack of action. If you are embarrassed, ashamed, or guilted into thinking that you should have been able to prevent these problems on your own, it can be harder to come forward and ask for help.

How Can I Cope With Financial Stress?

The first step in coping with financial stress is to take a hard look at what’s bringing about this feeling. Is it because money is so tight each month? Do you feel like all of your time is spent working, either part-time or full-time jobs, but still not making enough money? Are you constantly juggling bills and loans just to stay afloat?

Live Within Your Means

If the issue is lack of funds and not knowing where the next dollar will come from, work on living within your means and tracking every purchase you make. If it’s taking up all of your time to keep the lights on, consider looking for a higher-paying job or another part-time gig that will allow you to cover expenses and still have some free time.

Pick Up An Extra Shift

For those who are stressed because they feel like they’re not pulling their own weight financially, ask yourself if there is anything else that can be done. Can you pick up an extra shift? Is there any other revenue coming in? Do you need to work on finding new ways to earn money rather than letting bills pile up every month so finance becomes an issue?

More Doing

Because stress is inherently caused by feeling out of control, focus on what you can do now instead of worrying over how things will play out later. If you feel like you are always putting out fires, consider what steps you can take to minimize the number of emergencies that come up or how much time they require. Pay attention to your spending habits and find ways to cut back so there’s more money for essentials instead of blowing it all on unnecessary items.

Seek Professioinal Help

If these issues are overwhelming, seek help from a career counselor or financial adviser who can help you with long-term plans that will put your mind at ease. Even if the situation is not easy to fix immediately, working with professionals who understand your needs can give you peace of mind knowing that someone knowledgeable is on your side and willing to assist however possible. Lastly, don’t hesitate to ask for advice from family members or friends — sometimes getting an outside perspective can offer a fresh perspective or ideas on how to get back on track.

Mental Stress

These two problems go hand in hand, and most people feel them both at once. Signs of mental health stress include:

- Lack of energy

- Lack of motivation

- Feeling overwhelmed or emotional

- Loss of interest in things you usually enjoy

Signs of Financial Stress

Signs of financial stress include:

- Constant worry and stress about money

- Feeling like you’re drowning in debt, bills, and overall financial problems

- Taking on more work or a second job to make ends meet

People will sometimes neglect their mental health because the psychological effects of the two issues often feel similar. The fact that finances are such a big part of your daily life can make it hard to differentiate between the two.

Effects Of Financial Stress On Your Mental Health

The effects of financial stress can be long-lasting and irreversible. Living with stress increases your risk for health problems like heart disease, digestive problems, depression, anxiety disorders, and more. It can also increase your risk for mood disorders like bipolar disorder or schizophrenia.

Financial stress stems from many different factors in life that are often out of our control. Perhaps you’re not earning enough to afford the basics in life, or you’re juggling bills and loans just to stay afloat. Financial stress is one of the most common sources of psychological distress because it’s so difficult to suppress worry or worry about money when it’s all around us. Financial stressors are typically much more powerful than their psychological counterparts because they affect us on so many levels, from the material to the mental.

Uncontrollable Financial Stress

Many times the source of financial stress is outside of our control. It’s not always caused by poor planning or careless mistakes — sometimes we lose a job during hard economic times and we can’t replace it right away. Sometimes we take on debt and struggle to pay it back, and there’s nothing we can do but make the minimum payments each month and pray they don’t keep going up or that we don’t experience further financial stressors like a health crisis.

These uncontrollable factors lead to stressful anxiety about money that pervades your thoughts and feelings all of the time. The constant stress wears down on us emotionally because worrying is exhausting, which only makes things worse over time as you feel more helpless in the face of what you have no control over.

Financial Stress Causes Psychological Stress

When these issues enter our psyche, they create psychological distress as a result of their effects on our moods. For example:

- When you’re worried about money, it’s hard to concentrate or focus on anything else. You might snap at the people around you because of financial stress and anxiety

- Your thoughts are preoccupied with your financial debts, your credit score, your bank account balance. How much money is in there, when did you last put more cash in? It occupies mental time that could be used for other things like family or leisure activities

- The constant worry about money keeps us up at night. We sleep less than normal, which wreaks havoc on our physical health. Even if we do fall asleep, we may not rest well because of the ongoing stress

Financial Stress Affects Physical Health

Stress causes changes in the body due to the increase in cortisol, the primary stress hormone.

- Physical signs of financial stress can result in anxiety and worries about appearance

- People might overeat or go to unhealthy lengths like smoking cigarettes because of increased stress they’re experiencing over finances

- We may withdraw from friends and family to avoid causing them strife when our own emotions are turned inward on ourselves

These effects build up over time without us realizing just how serious they are. Eventually, these issues will have physical effects that require medical attention, which compounds an already stressful situation that doesn’t seem to get better. Additionally, many people don’t seek treatment for mental health concerns because of the stigma surrounding mental illness so it’s likely someone suffering from depression brought on by financial distress will never seek help.

Ways to Address These Stress

There are a few signs that you’re experiencing both financial stress and mental health issues. But there are plenty of ways you can start taking care of yourself today.

– Take care of your physical health – manage your diet, exercise regularly, and get an adequate amount of sleep each night.

– Make a budget and create a plan to get out of debt.

– keep track of your expenses, make a list of things you need/want to buy. And only spend money on the essential items from your necessities list. This will force you to prioritize, which can help take some pressure off.

– Create a support system – talk to friends and family about your financial woes, and if you’re feeling overwhelmed or stressed out, ask them for help. You can also join a community like The Money Coaches (choosecoaching.com) to build a professional support team.

– Reach out for professional help – there are plenty of free resources and programs available to help you address financial stress, so if you feel overwhelmed or unable to tackle it alone, don’t hesitate to reach out.

Tips for Combating Financial Stress on Your Own

There are a lot of resources and support options in order to combat financial stress on your own. There’s a difference between feeling stressed and knowing that something needs to be changed. And it all starts with doing research and getting educated.

- Read blogs like this one that discuss tips for financial stress

- Join a community or find a support group that has people who understand what you’re going through

- Make sure your bills and debts are paid and you have a plan to stay on top of them

- Get yourself out of situations that will continue to make your financial stress worse. Like getting involved with high-interest credit cards

- Set limits for yourself – decide how much money you can spend each month. And then stick to it as best as possible. If you’re not sure how to start, use cash for your purchases instead of cards

Seek Help If You Need It

There are plenty of great resources out there available to help you. The key is finding what works for you and taking advantage of the support that’s available. If you’re not sure where to find it, ask a therapist or psychologist for help.

– Talk to a therapist or counselor – ask them what resources are available in your area for financial stress

– Look into programs – most cities have free support options, so check with your community office. There are plenty of professionals that specialize in financial stress and can provide individual therapy.

– If you need more help, there are some free and low-cost programs that provide long-term treatment for financial stress and mental health issues.

Conclusion

Financial stress can have a negative impact on mental health. With this in mind, it’s important to take steps now to relieve financial stress and prevent the downward spiral of poor mental well-being. The first step is identifying your sources of financial strain so that you know where to start making changes. Be sure to explore all avenues for relief including budgeting, reducing debt. Or find other ways to make more money as needed over time.

If you are looking for affordable Online Counseling for guidance on financial stress management MantraCare can help: Book a trial therapy session